Commercial solar O&M—short for operations and maintenance—covers every task required to keep a photovoltaic asset safe, compliant, and producing at peak output. If you manage a rooftop or ground-mount array, you already know the stakes: an unplanned outage can erase months of energy savings, vague proposals make apples-to-apples comparisons impossible, and a single safety lapse may shift liability onto your balance sheet.

This guide turns that knot of worries into a clear action plan. You’ll see exactly which services protect revenue, how much quality O&M should cost, and why proactive care beats “run to fail” every time. We’ll unpack the jargon, map out core service elements, show you how to vet providers, model budgets, negotiate airtight contracts, and finish with a practical checklist you can bring to your next board meeting. Read on to choose a partner who keeps your investment earning year after year.

Commercial solar O&M in plain English

Think of operations as everything that happens from the control room: real-time monitoring, fault detection, remote resets, performance analytics, and reporting. Maintenance is the hands-on work in the field: inspections, cleaning, torque checks, vegetation control, repairs, and warranty claims. Together they form the backbone of commercial solar O&M services—an ongoing program designed to keep your asset safe, compliant, and earning kWhs.

A workmanship warranty that accompanied your installation only covers defects in labor or materials for the first few years. It does not include routine site visits, data analysis, or emergency dispatch. An O&M contract fills that gap with a defined service schedule, performance metrics, and financial remedies when standards aren’t met.

Typical system components covered under a well-written scope:

- PV modules (panels)

- Inverters (string, central, or micro)

- Racking & trackers

- Combiner and re-combiner boxes

- DC and AC wiring, conduit, and junction boxes

- Monitoring hardware and gateways

- Energy-storage units (battery racks, PCS, BMS)

- Weather stations, revenue-grade meters, and data loggers

Terminology that appears in contracts

- SLA (Service Level Agreement) – the uptime or response metric the provider must hit.

- SCADA – supervisory control and data acquisition platform that collects live plant data.

- IV curve tracing – electrical test that reveals module or string degradation.

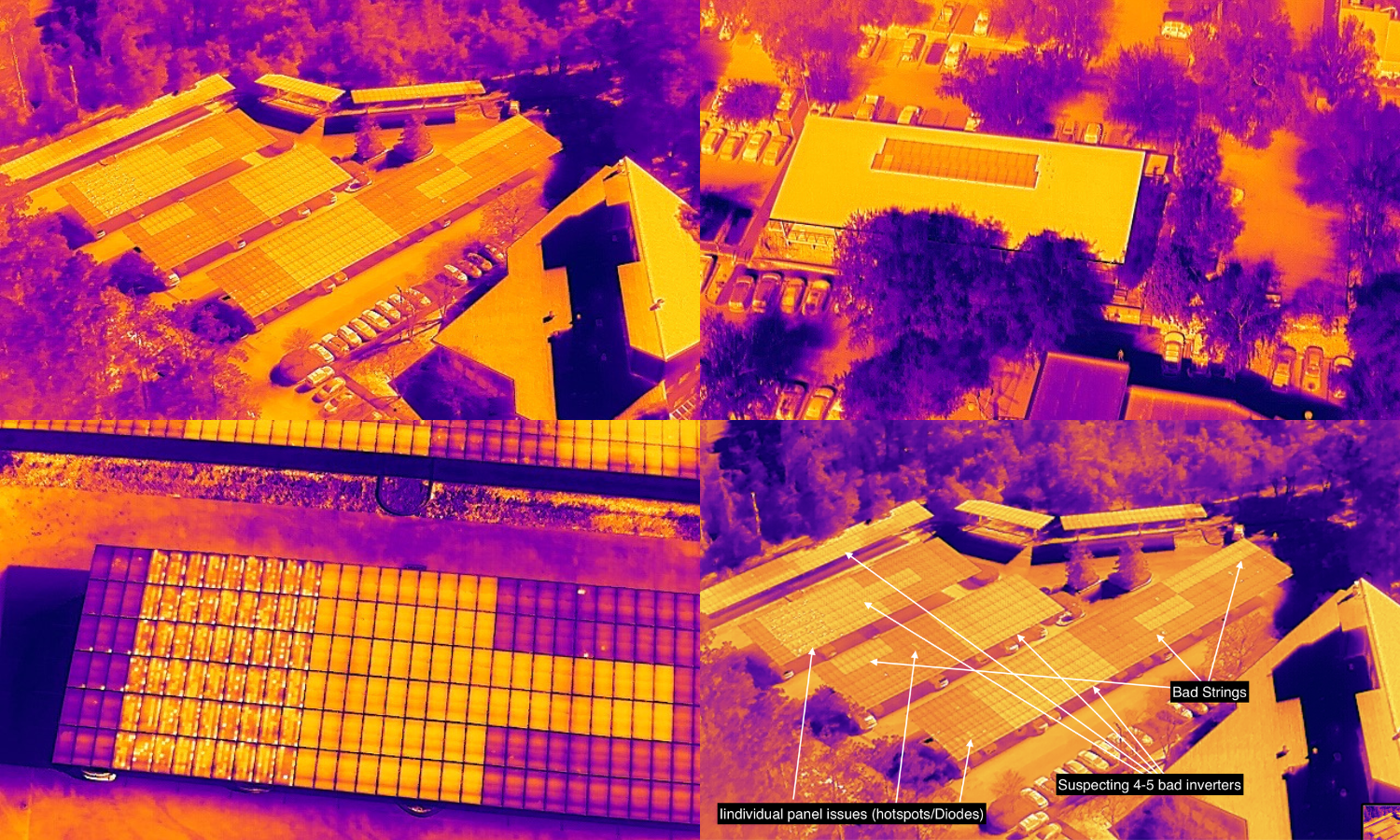

- Thermography – infrared imaging used to spot hot spots, loose lugs, or diode failures.

- CMMS – computerized maintenance management system that tracks work orders.

- MTTR (Mean Time to Repair) – average hours from fault alert to fix.

- Asset availability – % of time the system can produce when irradiance is present.

- Performance ratio (PR) – actual vs. expected energy after normalizing for weather.

Minimum compliance vs. best-practice maintenance

| Task category | Basic (meet code) | Standard (protect ROI) | Premium (optimize yield) |

|---|---|---|---|

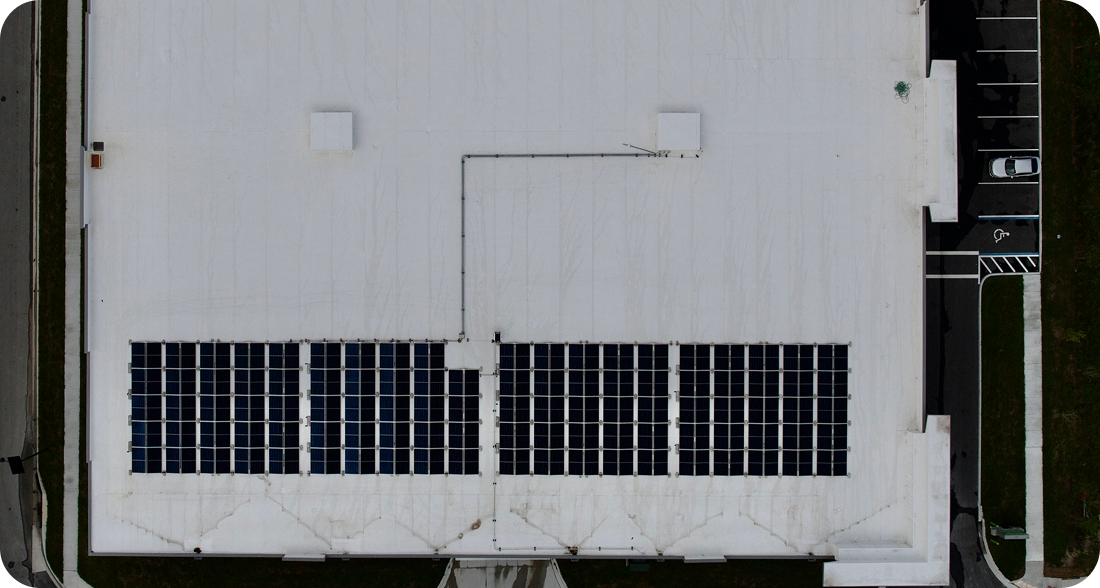

| Site inspection | Annual visual | Semi-annual with torque check | Quarterly plus drone survey |

| Cleaning | None (owner led) | 1× per year | 2–4× per year, water-quality spec’d |

| Monitoring | Next-day alert review | 24/7 automated alerts | 24/7 + analytics & benchmarking |

| Electrical testing | None | 5-year IR & continuity | Annual IV curve + IR scan |

| Response time | 5 business days | Next business day | ≤4-hour critical dispatch |

Legal codes only demand the “Basic” column; adopting Standard or Premium keeps production and warranties intact.

Why high-quality O&M directly affects ROI and risk

Every kilowatt-hour your array fails to deliver is a dollar you never see again. Field studies from NREL and utility PPA portfolios show common, preventable losses:

- Soiling: 3 – 7 %

- Inverter and combiner faults: 2 – 5 %

- Undiagnosed module degradation & shading creep: 1 – 8 %

Take a mid-size 500 kW rooftop in Florida that should generate roughly 500 kW × 1,400 kWh/kW = 700,000 kWh a year. Even a modest 10 % shortfall equals 70,000 kWh. At an average commercial tariff of $0.12 /kWh, that’s $8,400 in lost revenue or bill offset annually—more than the price of a robust O&M plan for the same system. At 20 % underperformance the hit doubles to $16,800 every single year. High-quality commercial solar O&M services convert those “invisible” losses back into cash by attacking the root causes before they snowball.

Impact on equipment warranties and safety

Manufacturers routinely require documented inspections, torque checks, and firmware updates to keep 10- to 25-year warranties valid. Miss a deadline and the burden of a $15,000 inverter replacement could land on you. Thorough record-keeping from a professional O&M provider also reduces electrical and fire hazards: thermal imaging spots hot connectors, IV curve tracing flags failing diodes, and rapid inbound dispatch isolates faults before they endanger personnel or property.

Regulatory and utility compliance obligations

Beyond performance, your array must stay on the right side of the rulebook. A competent O&M firm navigates:

- NEC Article 690 updates for DC arc-fault and rapid-shutdown hardware

- OSHA 1910 fall-protection and lock-out/tag-out procedures for rooftop work

- Local fire-code access pathways and labeling requirements

- Utility interconnection standards (IEEE 1547, Rule 21 equivalents) including annual relay testing and re-certification

Skimp on compliance and you risk fines, forced shutdowns, or voided interconnection agreements—costs that dwarf any savings from bargain-basement maintenance!

Core service elements to compare

Before you look at price tags or fancy dashboards, line up the actual tasks each bidder is willing to perform. A solid commercial solar O&M services scope should read like a field-ready playbook, not marketing fluff. Start by confirming that the proposal includes every item below and notes how often it will be performed:

- 24/7 performance monitoring with automated alerts

- Remote fault diagnostics and resets

- Scheduled site inspections (roof, ground, electrical rooms)

- Module cleaning sized to local soiling index

- Vegetation management or snow removal, where applicable

- IV curve testing and thermographic scans

- Corrective dispatch and on-site repairs

- Spare-parts stocking and warranty claim management

- Monthly and annual performance reporting tied to SLAs

Monitoring & data analytics

Behind every productive array is a data stack that never sleeps. The provider should specify the hardware (data logger, weather station, cellular or fiber backhaul) and the analytics platform—whether it’s proprietary SCADA or a third-party tool. Look for:

- Sub-string granularity that flags a single failed fuse or bad diode, not just inverter-level alarms

- Alert thresholds that combine irradiation and production (

kWh/kW) so false positives don’t swamp technicians - Machine-learning or rules-based comparisons that surface anomalies like daily yield deviation greater than 5 % or phase imbalance over 2 %

- A ticketing link between the monitoring portal and the CMMS so faults auto-generate work orders and track MTTR

If a vendor can’t demonstrate real-time screenshots and sample reports, keep shopping.

Preventive maintenance tasks and frequencies

Preventive work is the cheapest insurance you’ll ever buy for a PV asset. Ask each provider to map their visits on a calendar similar to the one below and to cite the ASTM, IEC, or manufacturer guideline that backs each task.

| Month | Task | Notes |

|---|---|---|

| Q1 | Full visual inspection & inverter firmware check | 2-person crew, 100 % array coverage |

| Q2 | Module cleaning round #1 | Deionized water, TDS & brush spec listed |

| Q3 | Torque audit of mounting hardware | Sample 10 % hardware or 100 % if trackers |

| Q4 | IV curve tracing & IR scan | Baseline health report delivered |

| As-needed | Vegetation control / snow clearance | Triggered when shading >2 % |

Consistency matters: a skipped cleaning in a high-dust region can slash annual yield by 4–6 %.

Corrective maintenance & emergency response

Even with stellar preventive care, things break. Evaluate how quickly—and how transparently—the provider will react:

- Response tiers: critical events (complete inverter outage) within 4 hours, major (string loss) next business day, minor (sensor fault) within one week

- Local inventory: common inverters, fuses, transducers, and MC4 connectors stocked within 150 miles to cut shipping delays

- Escalation path: technician → senior engineer → manufacturer RMA desk, all logged in the CMMS with time stamps

- Documentation: root-cause analysis, photographs, replaced part numbers, and a signed safe-return-to-service certificate uploaded within 48 hours

How to evaluate and shortlist potential providers

A seductive slide deck is not enough—you need proof that the company you hire can protect revenue and handle risk for the next two decades. Build a structured funnel that starts wide and narrows fast:

- Desktop research. Compile a list of firms offering commercial solar O&M services in your region; discard any with less than three years in business or no commercial references.

- Issue a concise RFP. Lay out system specs, expected scope (use the checklist above), and ask for pricing in $ / kW-AC-yr as well as a fixed annual total.

- Host site walk-throughs. Invite the top five bidders to inspect the array, rooftop access points, electrical rooms, and fire lanes. This weeds out lowball bids based on guesswork.

- Conduct reference checks. Speak with at least two clients that have similar system sizes and technology. Focus on responsiveness, data transparency, and warranty support.

- Score with a weighted matrix. Rate each bidder on technical capability, cost, safety record, and reporting. Shortlist the top two for final negotiations.

Technical credentials and experience

Look for hard credentials:

- NABCEP technicians on staff

- OSHA 30 or OSHA 510 safety training for field crews

- FAA Part 107-licensed drone pilots for IR surveys

A credible firm shows a portfolio that matches your asset class—rooftops, trackers, central inverters, battery hybrids. Ask for production data from at least three comparable sites and verify uptime claims against utility bills.

Financial stability and insurance coverage

A provider that folds mid-contract leaves you scrambling. Review:

- General liability insurance certificate presented by provider

- Workers’ comp that meets state thresholds

Ensure your organization is certificate holder before the first on-site visit.

Transparency and reporting culture

The best commercial solar O&M services operate like an open book:

- Real-time dashboard access with role-based logins

- Monthly KPI packet covering uptime %, PR, MTTR, and open tickets

- Quarterly safety and incident reports

- Annual budget-vs-actual review with action items

If a bidder refuses to share raw data, glosses over failures, or can’t commit to regular review calls, move on—opaque reporting is a red flag you can’t afford.

Understanding pricing models and typical cost ranges

Sticker price for commercial solar O&M services is usually quoted in $/kW-DC-year, but the meter is running in different ways depending on the contract. Before comparing bids, know which bucket each offer falls into and how that affects long-term cash flow.

- Flat fee – One all-inclusive price per kW. Simple for budgeting and common on rooftop arrays ≤1 MW.

- Tiered bundles – “Basic,” “Standard,” or “Premium” packages with escalating service scope (extra cleanings, IV curves, etc.). Good when sites have varying criticality.

- Performance-based – Provider receives a bonus or penalty tied to energy yield or availability. Aligns incentives but requires iron-clad data quality and dispute language.

For context, competitive numbers in 2026 look like this:

| Site type | Typical annual fee | Key cost drivers |

|---|---|---|

| Urban rooftop, 250–750 kW | $18–$28/kW-yr | crane access, foot traffic limits, higher soiling from pollution |

| Large ground-mount, 1–10 MW | $12–$20/kW-yr | terrain, vegetation growth, weather exposure |

| Tracker + battery hybrid | $22–$35/kW-yr | extra moving parts, BMS support, compliance testing |

Expect a one time setup fee when the provider assumes control, monitoring, and initial investigation of the project.

Hidden costs to watch for

The headline rate isn’t the whole story. Scrutinize proposals for:

- Mobilization or after-hours surcharges

- Per-event module washing fees (often $2–$5 per panel)

- Software licensing if you want direct SCADA access

- Travel above an included mileage radius

- Pass-through on spare parts with mark-ups exceeding 10 %

Financial modeling tips

Blend O&M into your pro-forma the same way you model insurance or property tax:

- Start with the quoted

$/kW-yrand apply an inflation escalator—conservatively 2 % for flat fees, 3 % for tiered bundles. - Add a contingency line equal to 10 % of annual O&M to capture unplanned inverter swaps or storm damage deductibles.

- Compare the net-present cost of O&M against the avoided production loss. For example, a 500 kW rooftop at $25/kW-yr costs $12,500 annually; avoiding even a 9 % performance hit at $0.12/kWh saves $7,560. Break-even is reached when proactive maintenance prevents ≥15 % losses—a threshold most arrays cross within the first three years without proper care.

Run these numbers and the “expense” of quality O&M quickly reframes itself as insurance for revenue, safety, and asset value.

Contract essentials you must negotiate

Before signing, make sure the document captures exactly who does what, how fast, and at whose expense. At minimum, your commercial solar O&M services agreement should spell out:

- Detailed scope of work linked to a task calendar

- Reporting cadence and data-ownership language

- Safety standards and site-specific procedures

- Termination and renewal terms, including buy-out options

- Spare-parts ownership and inventory obligations

- Escalation ladder for disputes and emergency events

- Insurance certificates

Service level agreements and performance guarantees

An SLA converts promises into measurable numbers. Typical benchmarks include:

| Metric | Minimum target | Remedy if missed |

|---|---|---|

| Critical fault response time | 24 hrs | Credit equal to estimated lost kWh × tariff |

| System availability | To be determined | Contract extension |

| Reporting delivery | Based on predetermined scheduled intervals | Available for analysis upon request |

Warranties, bonding, and risk allocation

Separate workmanship warranty (labor on fixes) from component warranties the provider manages with manufacturers. Confirm:

- Workmanship term matches or exceeds five years

- Provider handles RMA paperwork and reinstall without change-orders

Questions, red flags, and a handy due-diligence checklist

A structured Q&A session will expose weaknesses long before contracts are signed. Bring the list below to every interview and insist on concise, documented answers.

- Do you subcontract field work or use in-house crews?

- How many NABCEP-certified technicians will be assigned to my site?

- What is your average response time for an inverter failure?

- Can I access raw monitoring data and retain ownership of it?

- Which CMMS platform tracks work orders and MTTR?

- How often will you perform IV curve tracing and IR scans?

- What spare parts do you stock within 150 miles of my array?

- Describe your escalation ladder for critical faults.

- Have you ever failed to meet an availability guarantee? Why?

- Will you provide sample monthly reports from a similar system?

- How is annual fee escalation calculated after year one?

Watch for red flags like evasive answers, “too-good-to-be-true” pricing, no local technicians, expired insurance certificates, or reports that show only kilowatt-hours without PR and downtime metrics. Any one of these is a cue to walk away.

Transition plan for orphaned or aging systems

Switching O&M partners is painless if you follow three steps:

- Secure a full data handoff—past SCADA logs, drawings, warranty files.

- Schedule a baseline performance audit to identify hidden faults and create a corrective backlog.

- Overlap contracts for 30 days so the incoming team can shadow outgoing crews and assume responsibilities without any production gap.

Moving forward with confidence

A commercial PV plant is a revenue machine—if the right people keep it firing on all cylinders. Align scope, credentials, price, and contract language before signatures go down, and you turn potential downtime into predictable cash flow. Grab the checklist above, invite two or three qualified firms for site-specific proposals, and lock in proactive care before hidden faults erode your yield. Need a starting point? Reach out to PPM Solar for a complimentary O&M assessment and straight-talk quote tailored to your array.