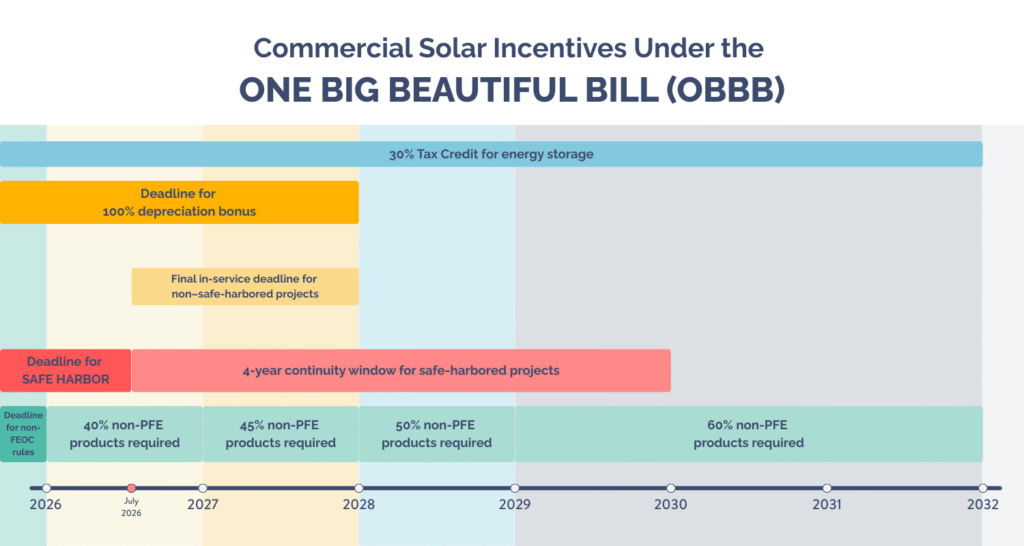

The rules for commercial solar tax credits changed completely on July 4, 2025, when the One Big Beautiful Bill (OBBB) became law. This legislation rewrote the timeline and terms for federal clean energy incentives that businesses have counted on for years.

For years, eligible businesses could claim a 30% federal tax credit on qualified solar investments—including commercial rooftop and ground-mounted systems—cutting upfront costs significantly and improving project returns. Under the previous Inflation Reduction Act (IRA) rules, that 30% credit was guaranteed through at least 2032. The OBBB changed everything with new deadlines and qualification requirements you must meet to keep your tax credits.

Projects larger than 1.5 MW must now satisfy the Physical Work of a Significant Nature Test. Miss this requirement or any other new rule, and you risk losing the entire 30% Investment Tax Credit (ITC). Projects that start after July 4, 2026, but aren’t operating by December 31, 2027, won’t qualify for any ITC at all.

The positive news? The 100% bonus depreciation stays in place—letting you fully deduct qualifying solar and energy storage assets in the first year. Standalone battery energy storage systems are now fully eligible under Section 48E, though they face the same sourcing rules as solar projects.

This guide will help you understand these changes and secure maximum commercial solar tax credits while you still can.

The commercial solar tax credit landscape has undergone significant changes, creating both urgency and opportunity for businesses planning solar investments through 2027.

- Act fast on the compressed timeline: Projects must begin construction by July 4, 2026, or be fully operational by December 31, 2027, to qualify for the 30% tax credit.

- Avoid Chinese equipment for future projects: Starting in 2026, projects need 40% non-Chinese-manufactured components to maintain tax credit eligibility under new FEOC rules.

- Leverage the Physical Work Test for larger systems: Projects over 1.5 MW must show substantial construction activity, not just equipment deposits, to qualify for credits.

- Maximize savings with bonus incentives: Combine the base 30% credit with domestic content (10%) and energy community (10%) bonuses, plus 100% first-year depreciation.

- Start planning immediately: Supply chain delays and permitting processes require 12-18 months lead time, making early action critical for meeting deadlines.

The window for maximum commercial solar tax benefits is rapidly closing, but businesses that understand these new rules and act decisively can still capture substantial financial incentives while transitioning to renewable energy.

Why Timing Matters for Commercial Solar Projects in 2025–2027

Time is running out for businesses planning solar investments. Legislative changes compressed the timeline for claiming valuable tax incentives, making strategic planning more critical than ever before.

The shrinking window for a full 30% credit

The Inflation Reduction Act (IRA) originally maintained the 30% commercial solar Investment Tax Credit (ITC) through 2032, before gradually phasing it down. The One Big Beautiful Bill Act (OBBB) changed everything. Commercial solar projects now face an accelerated schedule to secure these tax benefits.

The 30% tax credit still exists—but with major new restrictions. Commercial projects must either begin construction by July 4, 2026 or be fully placed in service by December 31, 2027. This cuts the window of opportunity by approximately five years.

What does this mean for your business? You need to make solar decisions much sooner than previously planned. The tax credit amount hasn’t changed, but the time to access it certainly has.

Key deadlines under OBBB and IRA

Three critical deadlines determine your project’s eligibility:

- December 31, 2025: Projects started by this date avoid Prohibited Foreign Entity (PFE) restrictions.

- July 4, 2026: Final deadline to begin construction under safe harbor provisions.

- December 31, 2027: Absolute deadline for placing projects in service for those who missed July 4, 2026 deadline.

The qualification method depends on the size of your project. Projects with a capacity of 1.5 MWac or smaller (roughly 2 MWdc) can still utilize the traditional 5% spend safe harbor approach. Larger systems must meet the more stringent physical work test, which requires visible, qualifying physical work underway before the deadline.

The physical work test requires substantial construction activities, such as foundation work, installation of rebar, or similar significant construction steps. Simply making equipment deposits may no longer qualify as “beginning construction” under forthcoming Treasury guidance.

Risks of waiting too long

Delaying your solar decision creates substantial financial risks. Beyond missing the 30% tax credit entirely, projects starting after July 4, 2026, must comply with stricter Foreign Entity of Concern (FEOC) requirements. These rules can significantly impact supply chain decisions and potentially disqualify projects from tax credits.

Industry bottlenecks are coming. Contractors, equipment suppliers, and permitting offices will face overwhelming demand as deadlines approach. This surge could extend project timelines, putting even well-planned projects at risk of missing crucial deadlines.

The financial impact is significant. A $150,000 commercial solar system generates a $45,000 tax credit if qualified, resulting in direct dollar-for-dollar savings. Without this incentive, project economics change dramatically, potentially extending payback periods by several years.

Utility electricity rates continue rising in many regions, so each month of delay represents lost savings. Commercial solar projects typically require several months from contracting to completion, so it is advisable to start the process well before the deadline dates to ensure qualification.

How to Qualify for the 30% Commercial Solar ITC

Obtaining commercial solar tax credits requires understanding specific IRS qualifications and taking the necessary steps to demonstrate that your project has commenced. The Internal Revenue Service provides clear guidelines for establishing eligibility for the 30% Investment Tax Credit.

Safe Harbor Methods: Cost vs. Construction

The IRS offers two primary methods to prove construction has begun on your commercial solar project: the Physical Work Test and the Five Percent Safe Harbor test. Each has different requirements and documentation needs.

Physical Work Test

This method focuses on the type of work performed rather than how much you spend. To qualify, you must begin “physical work of a significant nature”. Qualifying activities include:

- Off-site manufacturing of components like mounting equipment and inverters

- On-site installation of racks or structures to attach solar panels

- Pouring concrete foundations or installing support structures

Effective September 2, 2025, projects larger than 1.5 MW must use only the Physical Work Test method. This eliminates the previously available 5% safe harbor option for larger installations.

Five Percent Safe Harbor Method

This approach requires paying or incurring at least 5% of the total project cost in the year construction begins. Under recent guidance, specifically Notice 2025-42, this option remains available only for solar facilities with a nameplate capacity of 1.5 MW (AC) or less. The threshold applies specifically to alternating current capacity, not direct current.

The “three-and-a-half-month rule” provides some flexibility—you can treat property as delivered when payment occurs if you reasonably expect delivery within three and a half months.

Project Size and Aggregation Rules

Determining project size is critical under the updated regulations. The 1.5 MW threshold applies at the project level, as measured by nameplate capacity, when the project is placed in service.

The “integrated operations” rule requires combining multiple solar facilities if they:

- Share common ownership by the same taxpayer

- Are placed in service during the same tax year

- Connect to the same interconnection point

This prevents artificially dividing larger projects to qualify for the small solar exception. For credit eligibility and bonus adders, final IRS regulations consider multiple energy properties as a single project if four or more aggregation factors exist. This loosens the previously proposed requirement of only two factors.

Service Deadlines and Compliance

Both qualification methods require continuous progress toward project completion once construction begins. The IRS provides a key safe harbor: projects automatically satisfy the continuity requirement if placed in service by the end of the fourth calendar year after construction begins.

If construction began on August 20, 2025, the solar facility must be placed in service by December 31, 2029, to satisfy the continuity requirement. This four-year window provides essential flexibility for projects that establish the beginning of construction before critical deadlines.

The absolute deadline established in OBBB requires projects to be placed in service by December 31, 2027, regardless of when construction begins, unless they qualify for safe harbor extensions. Projects starting after July 4, 2026, face a compressed timeline of just 18 months from the construction deadline to final placement.

You must maintain thorough documentation throughout the process. Essential records include:

- Binding contracts for equipment and services

- Payment receipts and delivery confirmations

- Construction timelines and progress reports

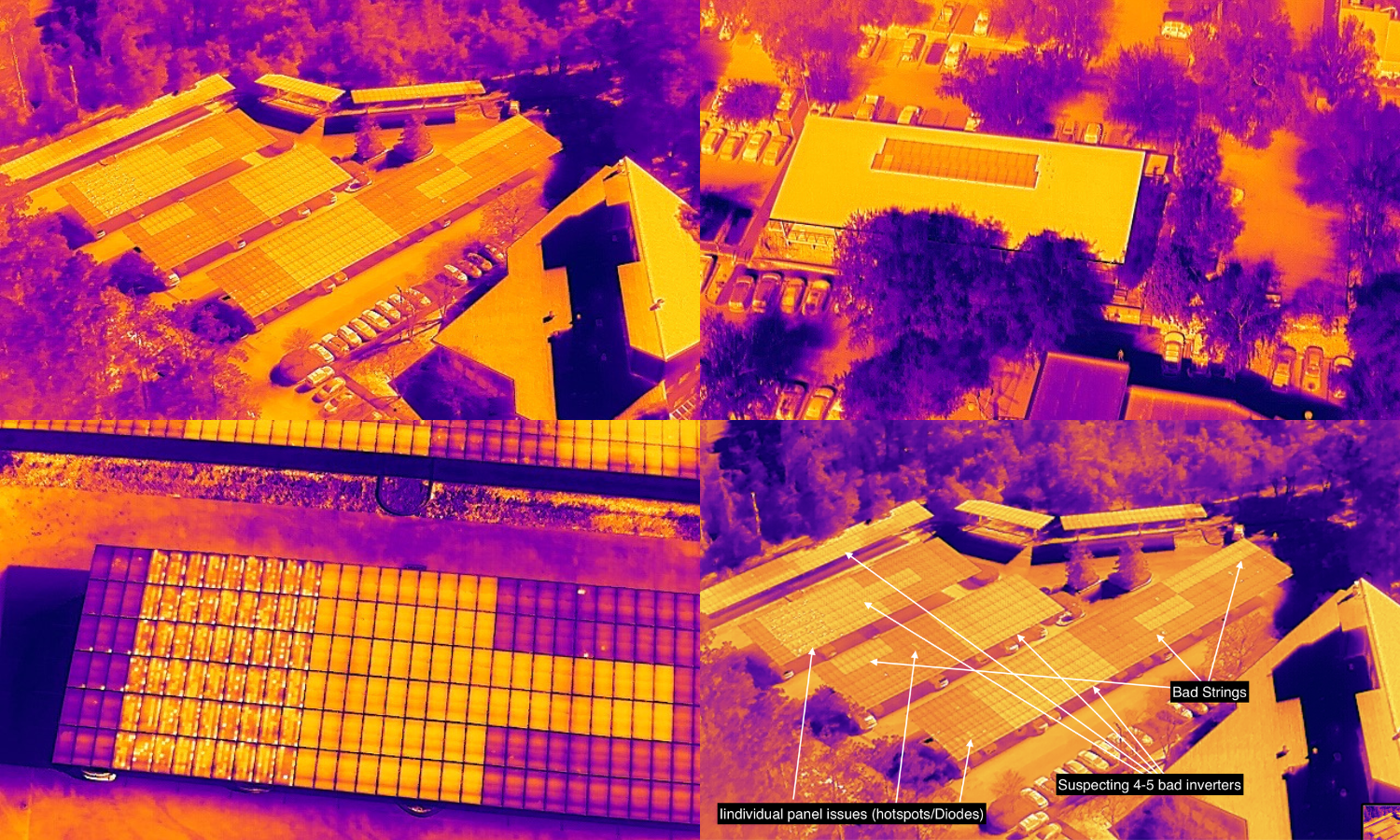

- Photographs documenting physical work

While qualification methods have changed, proper documentation remains the foundation for successfully claiming commercial solar tax credits during this period.

Avoiding Disqualification: FEOC and Sourcing Rules

Deadlines aren’t the only challenge. Commercial solar tax credits now face strict sourcing restrictions that can disqualify entire projects. The new Foreign Entity of Concern (FEOC) rules represent a fundamental shift in qualification requirements, making equipment sourcing a critical component for solar projects.

What is a Foreign Entity of Concern (FEOC)?

FEOC restrictions limit tax credit eligibility for projects receiving “material assistance” from a “prohibited foreign entity” (PFE) beginning January 1, 2026. A PFE includes two categories:

Specified Foreign Entity (SFE) includes entities specifically listed as national security threats, governments from covered nations (China, Russia, Iran, and North Korea), their citizens who aren’t U.S. residents, companies headquartered in these countries, or entities controlled by them.

Foreign-Influenced Entity (FIE) applies when an SFE can appoint executive officers, owns 25% or more of a company, multiple SFEs collectively own 40%+, or SFEs control 15% or more of the company debt. Payments to SFEs that give them “effective control” over facilities or equipment also trigger disqualification.

Projects beginning construction by December 31, 2025, will be exempt from these FEOC requirements entirely.

How to source safe solar equipment

For projects starting after 2025, you must calculate your “material assistance” ratio. This formula compares non-PFE-manufactured products against total project manufacturing costs.

To demonstrate compliance, you should:

- Obtain certificates from each supplier stating products weren’t made by PFEs.

- Document the costs of non-PFE manufactured products.

- Exclude costs from binding purchase orders signed before June 16, 2025 (for projects under construction by July 31, 2025).

The IRS will have six years (instead of three) to challenge FEOC compliance, with 20% penalties for miscalculations.

Non-Chinese solar module suppliers

Chinese companies control over 80% of global solar manufacturing. Several non-Chinese manufacturers offer viable alternatives:

- First Solar (USA): Specializes in thin-film panels with 12.7 GW capacity, expanding to 20 GW by 2025.

- Canadian Solar (Canada): Offers 14 GW capacity with planned expansion to 20 GW.

- Waaree Energies (India): Currently at 12 GW capacity, targeting 20 GW by 2025.

- Qcells (South Korea): Investing $2.5 billion in US manufacturing to reach 8.4 GW capacity.

- Vikram Solar (India): Provides 3.5 GW with plans for 7 GW by 2025.

FEOC thresholds for 2026 and beyond

Starting in 2026, solar projects must ensure that at least 40% of manufactured products aren’t from PFEs. This threshold increases annually by 5 percentage points, reaching 60% for projects after 2029.

Energy storage projects face stricter requirements, starting at 55% non-PFE content in 2026, rising to 75% after 2029.

These requirements demand early planning to secure compliant equipment sources, particularly as the industry moves away from Chinese supply chains.

Getting Extra Value with Bonus Credits and Depreciation

Beyond the base 30% credit, you can substantially increase your commercial solar tax credits through strategic planning and additional incentive opportunities.

Domestic content and energy community adders

You can boost your tax credits by an additional 10 percentage points through the domestic content bonus. This adder rewards projects built with US-manufactured components. For solar installations, the Treasury Department has established an optional safe harbor with alternative cost percentages that recognize manufacturers using cells made with domestically produced wafers. To qualify, projects must include steel, iron, or manufactured products produced in the United States at specific percentages—starting at 40% for projects beginning construction before 2025 and increasing to 55% after 2026.

The energy community bonus provides another 10 percentage point increase for qualifying locations. Projects qualify if 50% or more of their nameplate capacity is located in one of three types of areas: brownfield sites, census tracts with closed coal mines or retired coal power plants, or areas with significant fossil fuel employment. This incentive effectively reduces project costs by approximately $12.50 per kW-year for solar installations.

Battery storage and energy storage ITC

The Inflation Reduction Act extended standalone ITCs to energy storage technologies with a minimum capacity of 5 kWh. Battery systems no longer need integration with solar to qualify for tax credits. Storage projects placed in service after December 31, 2022, are eligible for the full 30% credit if they meet prevailing wage requirements. Battery storage systems remain eligible through 2032, thereby avoiding the accelerated construction deadlines that affect solar.

Using 100% bonus depreciation effectively

The OBBB permanently restored 100% bonus depreciation. This allows you to deduct the entire depreciable basis of solar assets in the first year rather than spreading costs over the standard five-year MACRS schedule. Because of ITC interaction rules, 85% of a system’s cost qualifies for depreciation (original cost minus half the ITC value). For a $300,000 commercial system in a 24% federal tax bracket, this generates approximately $61,200 in first-year tax savings through depreciation alone.

Action Plan for Businesses and Developers

The changes to commercial solar tax credits require immediate action. Here’s how to secure these incentives before the window closes.

Review your construction and procurement timeline

Planning ahead determines whether you qualify or miss out entirely. Supply chain delays and permitting processes often take 3-6 months, so it is recommended to start projects at least 12-18 months prior to key deadlines. If you’re targeting the 2026 deadline, start procurement discussions now to secure compliant equipment and qualified contractors.

Work with a qualified commercial solar installer

Your choice of solar developer can make or break your tax credit qualification. Look for partners who show:

- Proven success with tax credit qualification

- Current knowledge of FEOC regulations

- Established relationships with non-PFE manufacturers

- Experience documenting construction commencement

Document everything for IRS compliance

Documentation protects you from potential audits. Keep both digital and physical records of:

- All contracts, deposits, and payments

- Physical construction timelines with photographic evidence

- Equipment certificates verifying non-FEOC status

- Energy community or domestic content qualification proof

Stay updated on IRS and Treasury guidance

Rules continue changing as regulations develop. Stay informed through industry associations, Treasury updates, or tax professionals specializing in renewable energy. This ensures you make decisions based on current rules rather than outdated information.

Conclusion

Commercial solar tax credits remain a valuable financial tool for businesses, despite the changes introduced by the OBBB legislation. The compressed timeline creates both challenges and opportunities for businesses considering solar investments. The shift from a guaranteed 30% credit through 2032 to accelerated deadlines requires immediate attention and planning.

Time is the most critical factor for businesses considering solar investments. Projects must either begin construction by July 4, 2026, or achieve full operation by December 31, 2027. Larger projects exceeding 1.5 MW are subject to stricter qualification requirements through the Physical Work Test, rather than the simpler 5% Safe Harbor method.

The new FEOC regulations add complexity, especially for projects starting after 2025. You must carefully evaluate equipment sourcing, considering non-Chinese manufacturers as viable alternatives to maintain tax credit eligibility.

Significant financial benefits await companies that successfully meet these requirements. The permanent restoration of 100% bonus depreciation allows you to deduct the entire depreciable basis of solar assets immediately. Combined with potential bonus credits for domestic content and energy community location, commercial solar installations can achieve favorable economics despite regulatory complexity.

Success depends on thorough preparation. Establish realistic timelines, partner with experienced solar developers, maintain comprehensive documentation, and stay updated on Treasury guidance. As deadlines approach faster than expected, businesses that act promptly can still secure substantial tax benefits while transitioning to renewable energy sources.

The path to maximum commercial solar tax credits has become more complex, but the financial rewards remain significant for those who understand the rules and act decisively before these opportunities expire.

FAQs

When is the deadline to qualify for the 30% commercial solar tax credit?

To qualify for the 30% commercial solar tax credit, projects must either begin construction by July 4, 2026, or be fully operational by December 31, 2027. It’s crucial to start planning well in advance due to potential supply chain delays and permitting processes.

How do the new Foreign Entity of Concern (FEOC) rules affect solar projects?

Starting in 2026, solar projects must ensure at least 40% of manufactured products aren’t from prohibited foreign entities to maintain tax credit eligibility. This percentage increases annually, reaching 60% for projects after 2029. These rules primarily target Chinese-made components.

What’s the difference between qualification methods for small and large solar projects?

Projects 1.5 MW or smaller can still use the 5% spend safe harbor approach. Larger systems must meet the more stringent physical work test, which requires visible, qualifying physical work to be underway before the deadline, not just equipment deposits.

How can businesses maximize their solar tax benefits beyond the base 30% credit?

Businesses can boost their tax credits by an additional 10 percentage points each through the domestic content bonus and energy community bonus. Additionally, the 100% bonus depreciation allows for immediate deduction of the entire depreciable basis of solar assets in the first year.

What documentation is essential for IRS compliance regarding solar tax credits?

Comprehensive documentation is crucial. Businesses should maintain records of all contracts, deposits, and payments, physical construction timelines with photographic evidence, equipment certificates verifying non-FEOC status, and any proof of qualification for additional bonuses like domestic content or energy community adders.