Choose the best option to purchase your solar system

Solar generates an attractive ROI

Slash your bills, keep your savings!

After making a decision to go solar, the next step is selecting the best financing option. The vast majority of homeowners will not pay cash for their solar system but will finance it with zero downpayment. Even with over three million residential solar installations across the United States, the solar industry is continuing to mature and grow at an exponential pace.

This is because financing solar energy systems is a faster, easier, and more cost-effective means of going solar than ever before. Solar payments offset another liability (electric bill) and therefore does not increase the cost of homeownership.

Let’s go over some of the common financing options available in Florida

Solar Loan

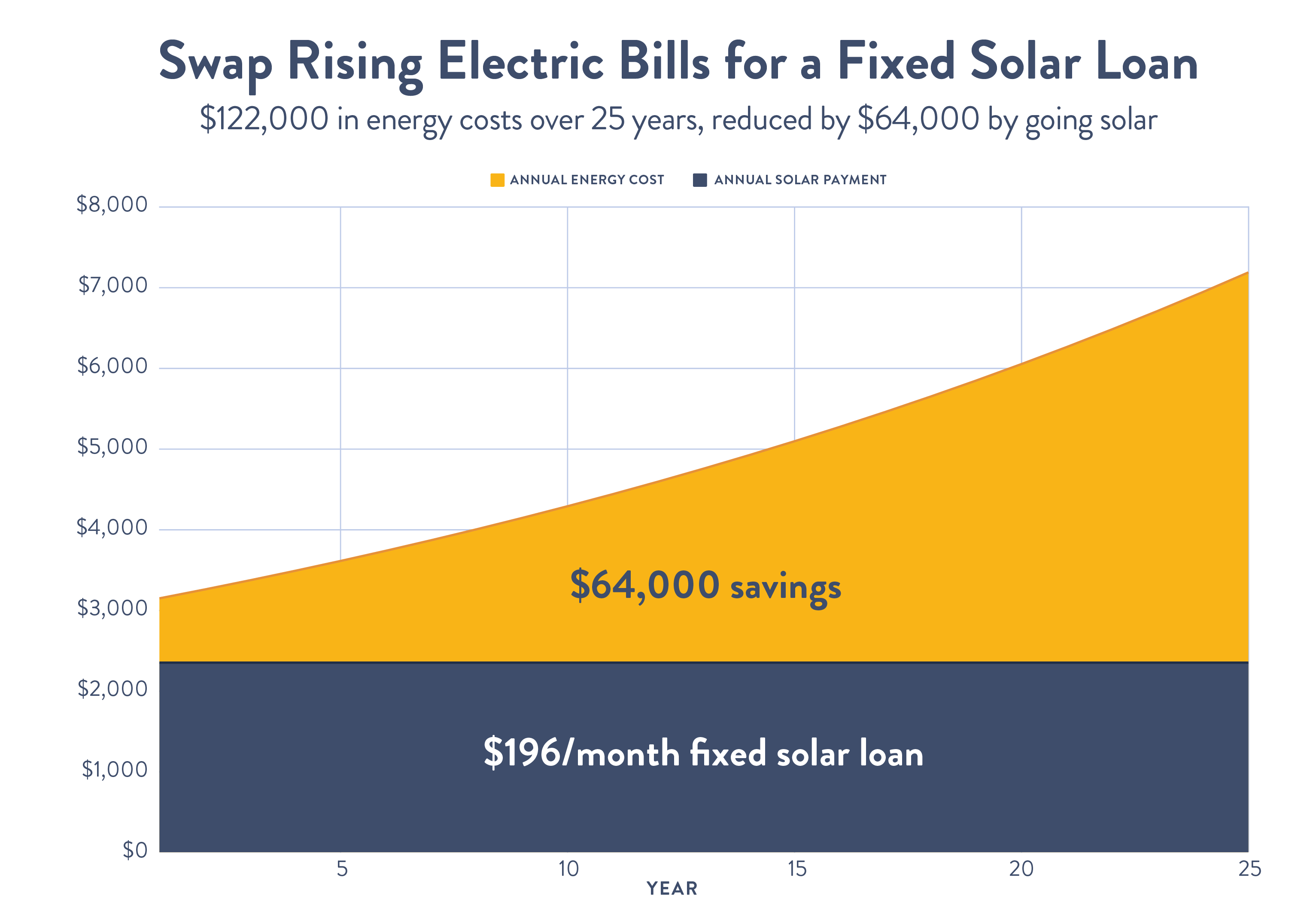

Reasons to consider a solar loan. A household with a $260/month electric bill will pay $3,120/year, assuming there are no rate hikes. The national average electric rate inflation over the last 25 years is ~3.5%. This scenario would mean that this same household will pay a whopping $122,692 for electricity in the next 25 years with zero ROI.

More about solar loans

Readily Available and Affordable. Solar Loans are the most common tool to go solar, typically aiming for what is commonly referred to in the industry as a “Bill Swapout.” This means that the solar savings will fully offset the post-tax credit solar loan, resulting in a cashflow-neutral advantage.

Instantly pays for itself. This is typically an easy decision for a homeowner because the benefits are clear: no change in homeownership costs while increasing the property value and generating clean electricity. The loan payment is fixed, and utility rates keep rising, resulting in ever-increasing monthly savings.

Warranty-Matching Lifecycle. The typical term at the time of this writing is 25 years, which matches the warranty on most major components.

Fixed Interest Rate. Solar Loan Interest Rate at the time of this writing is roughly ~8.5%. It is important to note that while the homeowner is paying interest on the solar loan, they are offsetting another expense by doing so, the interest rate should not be considered an additional expense or place the burden in the same way, say, the credit card debt would.

Can be tricky when it comes to rate buy-downs. Be wary of low-interest buy-down loans. Some contractors will manipulate the sales price to show a lower interest rate on the surface. A lower rate doesn’t always save money. If you sell your home, you may face a larger loan balance to pay off. Compare loan options carefully, especially since families often move every 7 years.

Home Refinance

Lowest Possible Payment. When financing or refinancing your home, if solar is included in the mortgage, it is typically the absolute lowest-cost option to finance your solar system.

Finance it before you build it. Installation of the PV system takes place after closing. It is that simple. For FHA mortgages, there is an option to provide funds to install solar through FHA’s Solar and Wind Technologies Program. These additional PV funds are limited to 20% of the home value.

Maximizing positive cashflow. For the solar project example above, the system would only cost about $190/month. This means that the solar is making it’s own monthly payment, leaving $70/month in your pocket. What could you do with extra $840 it saves in the first year alone?

Solar Lease

PPM does not recommend solar leases that are currently offered in Florida due to economic disadvantages. In the rest of the country, solar lease is a way to go solar without having to own the solar panels.

Disadvantages:

- More expensive than the Loan

- You don’t own your solar system

- Subordinates the Tax Credit to third-party finance

- In some cases, more challenging to sell the home, as the lease payoff is typically significantly higher

Advantages:

- No liability/maintenance for the solar system

- No payments if they don’t produce (in some cases)

- No need to file for tax credit (because you are not eligible)

Net Metering

Don’t wait. Securing net metering, if it is still available, should be an urgent priority if you are considering moving forward with the solar project. Utilities will typically grandfather in all existing net metering agreements during a policy change.

It’s going away as we speak. Net Metering is disappearing state-by state, utility-by-utility nationwide, as utilities use this tactic as a new way of combatting solar energy and reduce competitive pressure from rooftop solar.

PACE Financing

Property Assessed Clean Energy (PACE) is a solar financing option that attaches the bank-provided solar loan to property taxes of the home where it is installed. It was created at the time when access to conventional solar financing was limited, and additional securitization was required. Today, it is less advantageous compared to a conventional loan both with respect to interest rate and qualification process.

In addition, it leaves an assessment on the property taxes until the loan is paid off, making it, in some cases, harder to sell the home. PPM no longer offers PACE for these reasons.

Federal tax credit

Residential. Under OBBB, the 30% Residential Clean Energy Credit (§25D) ends after December 31, 2025. The old phase-down through 2034 no longer applies. Homeowners can still carry forward unused credit amounts to future years, but it remains non-refundable.

Commercial. Commercial projects can still qualify for the 30% ITC, but must safe-harbor/start construction by July 4, 2026 or be placed in service by December 31, 2027 if not safe-harbored. Businesses may also use 100% bonus depreciation (MACRS), which can materially improve project economics depending on tax appetite and compliance.

Nonprofit and Government.

Tax-exempt entities can still access the 30% credit via Direct Pay (elective pay) as a refundable Treasury payment. These projects follow the same OBBB deadlines and sourcing/compliance rules as commercial systems, with additional wage requirements for larger projects.

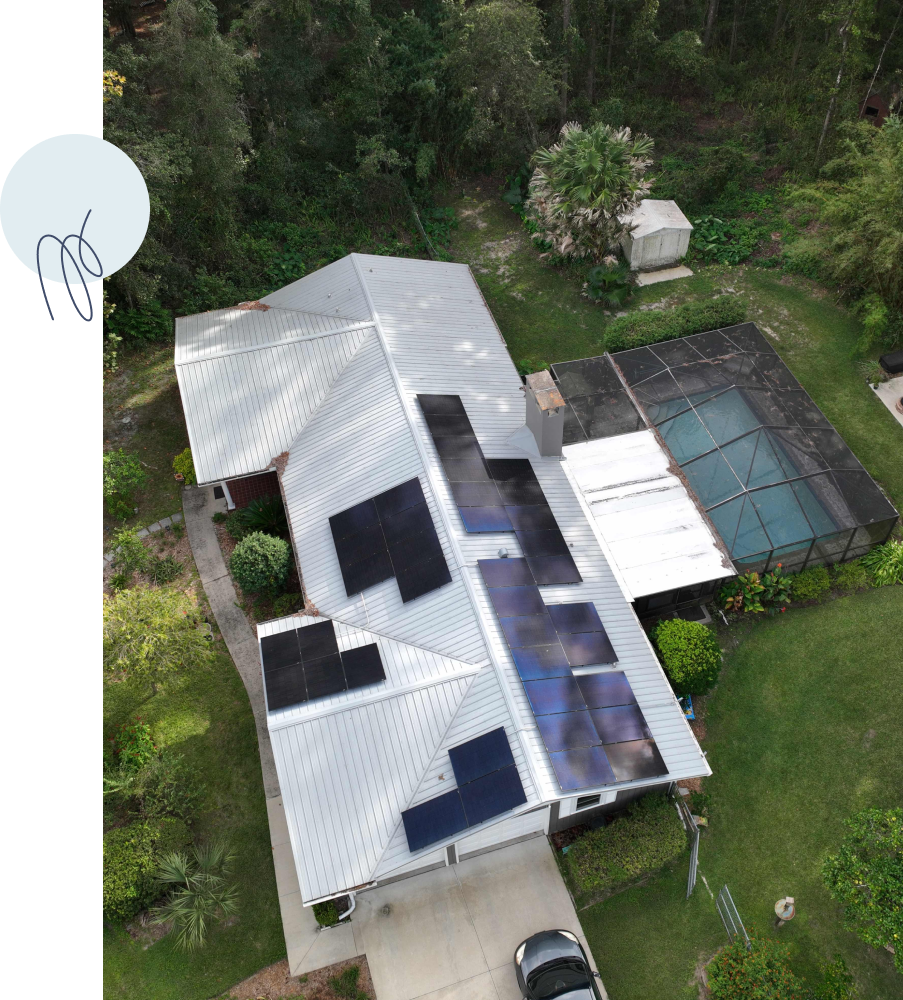

Our Solar Projects in North Central Florida

Frequently Asked Questions

What is the interest rate for solar loans in Florida?

Solar loans offered today are generally about one point above the prime interest rate, making them an affordable option to finance solar.

Can you finance solar panels in Florida?

Yes, and PPM can help you apply for some of the most competitive options out there. We make this process quick and easy for the future solar owners.

How long do solar panels take to pay for themselves in Florida?

Payback time for solar investment can vary based on sector, project complexity and size, and the utility rate. A solar system for a typical home in Florida will fully pay for itself in approximately 7 years, providing 18 more years of free electricity under a typical solar panel warranty. If upfront investment is not desirable, a financing option can be a better choice.

Can you sell back solar energy in Florida?

Your solar system first powers your home. Any extra energy can either go to the utility grid or be stored in optional batteries. This direct use of solar energy is called “Self-Consumption.” On average, a home uses about 40% of its solar energy, while the rest is exchanged with the utility company. You get credit for this excess energy, but you’ll also buy it back when needed. Utilities require your solar system to match your energy needs, not exceed them.

What type of loan is best for solar?

When financing a home, it is always better to roll solar into the mortgage. A conventional no-fee, no pre-payment penalty loan is the close second-best option. PPM offers several options that match those requirements.

Does Florida offer any solar incentives?

Yes! Florida exempts solar from Sales Tax (all projects) and Property Tax (for residential projects). So homeowners have the opportunity to add equity to their home without having to pay property taxes on it.

In Addition, Florida Public Service Commission (PSC) does require Investor-Owned utilities to comply with the state-wide Net-Metering Policy. This may change in the near future, but still remains the law of the land at the time of this writing.

Do banks give loans for solar panels in Florida?

Yes, and there are some that originated right here in the state, and are very purpose-driven to land for solar projects. Please contact us for more information.